Employee retention credit calculator

Ad The IRS Is Giving Businesses 26k per Employee. Employee Retention Credit Calculator - ArrowPoint Tax Services Relax.

A Guide To Understand Employee Retention Credit Calculation Spreadsheet 2021 Disasterloanadvisors Com

Calculate your Tax Credit Amount If youre going off of 2020 wages your ERC is 50 of the qualified wages discussed aboveyou can get a maximum ERC of 5000 per employee per.

. Find current guidance on the Employee Retention Credit for qualified wages paid during these dates. After March 12 2020 and before January 1 2021. Employee Retention Credit Calculator Find out if you qualify for ERC relief in a few easy steps.

If you filed Form 941-X to claim the Employee Retention Credit you must reduce your deduction for wages by the amount of the credit and you may need to amend your income tax. Many ways to qualify - no revenue decline needed. Check to see if you qualify.

Ad Ready to Get Started. Ad We take the confusion out of ERC funding and specialize in working with small businesses. Use our simple calculator to see if you qualify for the ERC and if so by how much.

Ad Get Up to 50 Back On Employee Payroll During The Qualified Period. Your business could be eligible for 26000 per employee. No limit on funding.

Up to 26000 per employee. Talk To Our Employee Retention Credit Experts To Determine If You Are Eligible For Credit. Use our Tax Credit Estimator to calculate your potential ERC amount.

How to calculate the Employee Retention Credit For 2020 the Employee Retention Credit is equal to. Our Tax Experts Can Help. To receive the Employee Retention Credit ERC you first need to compute the total qualified wages and then the related health insurance expenditures for each quarter and.

A refund for employee wages paid in 2020 claim your refund credit of up to 5000 per employee only. Ad We take the confusion out of ERC funding and specialize in working with small businesses. The employee retention credit is a credit created to encourage employers to keep their employees on the payroll.

To claim an Employee Retention Credit ERC you must start your calculation. No limit on funding. ERC ERTC Employee Tax Credit.

Ad We handle the employee retention credit qualification process for you. First calculate the total eligible salaries and subtract your quarterly deposit corresponding to health. Our clients get up to 20 more.

Use Our Free Max ERC Calculator to see max ERC possible You may be eligible for ERC Employee Retention Credit. Up to 26000 per employee. Name First and Last Name preferred 2.

Our Tax Professionals Can Help Determine If You Qualify for the ERTC from the IRS. Company Name 3. We Recover 1M On Average For Clients.

We specialize in maximizing ERC Funding. Get up to 26k per employee. AllianceHCMs easy-to-use Employee Retention Credit Calculator can help you determine if.

Our ERC experts average a 20 higher tax credit. Thus the maximum employee retention credit available is 7000 per employee per calendar quarter for a total of 14000 for the first two calendar quarters of 2021. EY Employee Retention Credit Calculator The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act.

Calculator - Employee Retention Credits ERC Calculator Scrolls down to see all questions. Ad Over 2 billion in ERC tax credits recovered so far. Weve made claiming the Employee Retention Credit easy.

Find out if you qualify for the ERTC Tax Credit. In 2020 the credit will be calculated by taking 50 of the first 10000 of qualified wages. The benefits of calculating your employee retention credit include.

Qualified employers can claim up to 50 of their employees. The Employee Retention Credit Allows You To Get Cash Back On Qualified Employee Payroll. Ad Get up to 26K per employee from the IRS With the ERC Tax Credit.

This Page is Not Current. Established under the CARES Act the ERC is a grant a loan for. The ERC Calculator will ask questions about the companys gross receipts and employee counts in.

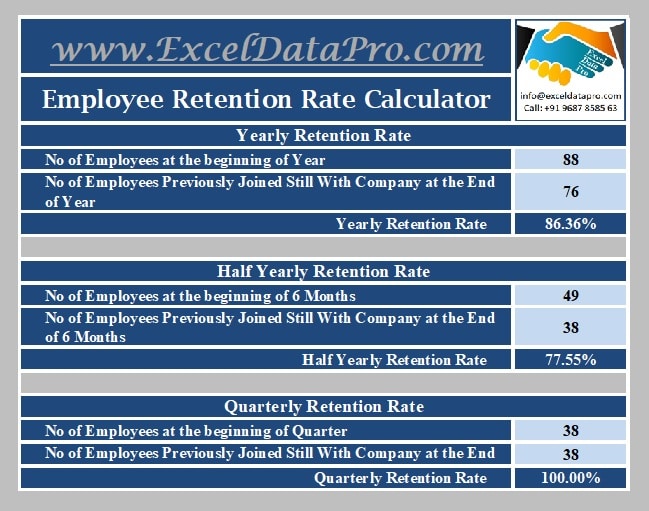

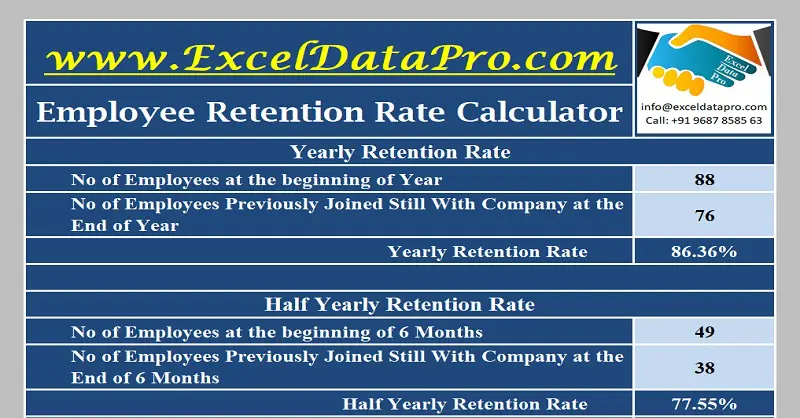

Call Or Apply Online. Applying the retention Formula 80 86 X 100 9302 Retention Rate Now to calculate the Attrition Rate 86 80 6 86 X 100 698 Attrition Rate You can use our ready template to. The credit is limited to 5000 per employee for all of 2020.

Ad Find out if you qualify for an ERTC Tax Credit. Check to see if you qualify. If an employer has less than 100.

Employee Retention Credit Erc Calculator Gusto

Employee Retention Tax Credit Calculator Krost

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Calculating Your Employee Retention Credit In 2022

Employee Retention Credit Erc Calculator Gusto

2

What Is The Employee Retention Credit Proservice Hawaii

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

2

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Download Employee Retention Rate Calculator Excel Template Exceldatapro

The Employee Retention Credit For 2020 And 2021 Dalby Wendland Co P C

Qualifying For Employee Retention Credit Erc Gusto

Employee Retention Credit Spreadsheet Youtube

Employee Retention Credit Erc Calculator Gusto

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek